80 New Cosmetic Ingredients in the First Half of 2025 Reveal Industry Trends

- Aug 11, 2025

- 4 min read

Recently, the National Medical Products Administration (NMPA) released a catalog of new cosmetic ingredients. Since the adjustment of China’s new cosmetic ingredient management policy in 2021, a total of 272 new cosmetic ingredients have been registered and filed as of the end of June 2025 (excluding canceled or voluntarily withdrawn filings).The dynamics of new cosmetic ingredient filings have now become a key indicator for industry development trends.

This article will dissect key insights from new cosmetic ingredient filings in the first half of 2025, offering a glimpse into emerging trends shaping the industry’s development trajectory.

Record Quantity Perspective

From January to June 2025, a total of 80 new cosmetic ingredients were publicly disclosed across the country, approaching the total number of filed products for the entire year of 2024 (90 products). The total number of filed products has increased by approximately 73.91% compared to 2024. On average, over 13 new products are filed each month, with an increase of approximately 5 new ingredients compared to 2024, demonstrating the vigorous momentum of ingredient innovation in the cosmetics industry.

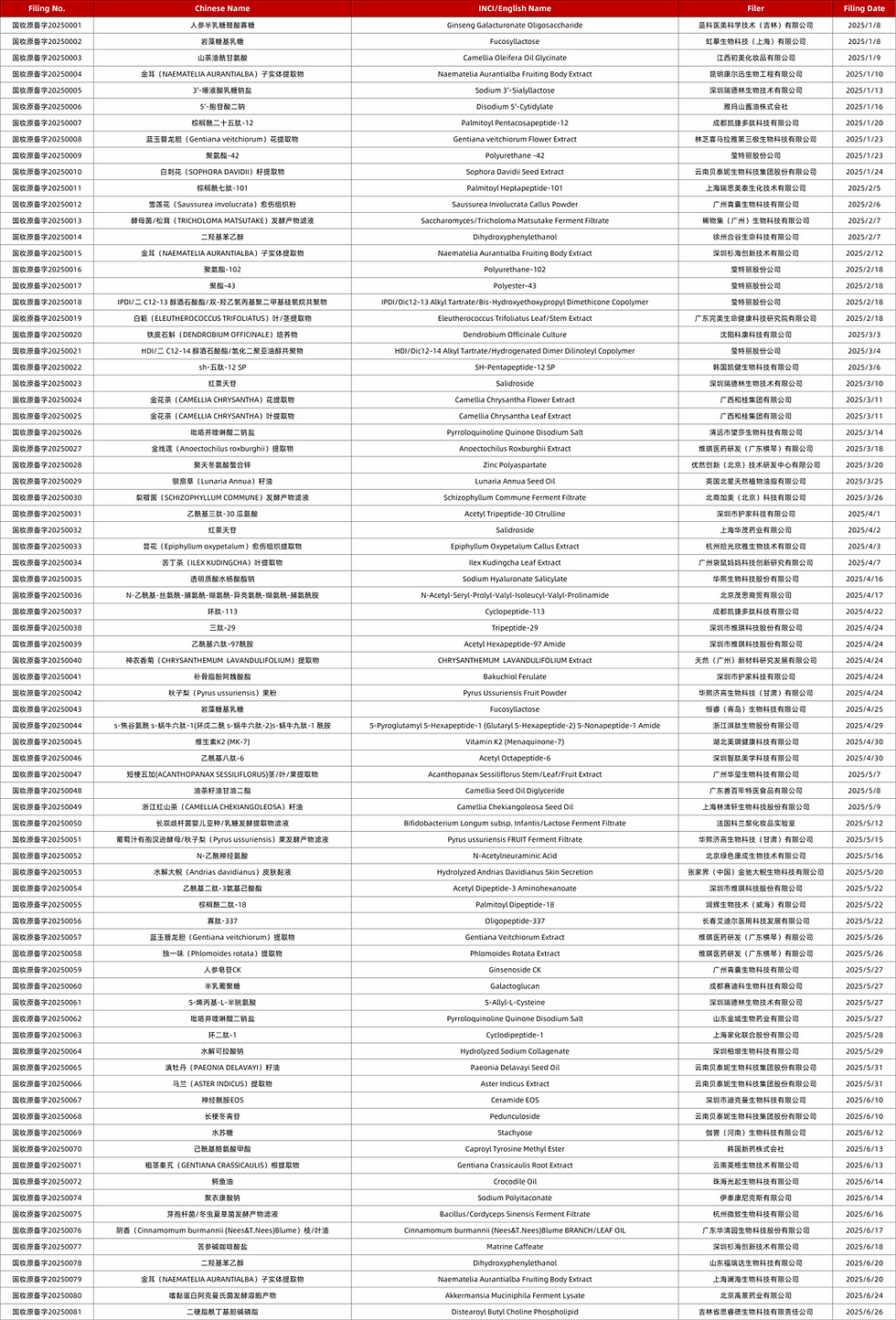

List of New cosmetic ingredients from January to June 2025

Geographical distribution of filing

In the first half of 2025, China's new cosmetic ingredient filings showed distinct regional distribution characteristics. Among the 80 newly filed ingredients, Guangdong Province held a significant advantage with 27 filings, accounting for approximately 34%, with renowned enterprises including Shenzhen Vicky and Guangzhou Xi Wuji among the filers.In the Yangtze River Delta region, companies such as Shanghai Lin Qingxuan and Hangzhou Weizhi contributed 10 filed ingredients. Among other regions:Beijing and Shandong each filed 5 ingredients (6.25%), Yunnan filed 6 ingredients (7.5%), Other regions accounted for 19%.Overseas filers secured approval for 11 new ingredients (≈13.75%), while domestic filings remained significantly ahead in volume.

Ranking of filing enterprises

Shenzhen Winkey Technology Co., Ltd. and its affiliated pharmaceutical company filed 6 new ingredients, topping the list for the highest number of filings in the first half of the year; Italy Intercos Group followed closely, filing a total of 5 new ingredients, 3 of which were polyurethane-based; Yunnan Botanee Bio-Technology Group Co., Ltd. focused exclusively on plant-derived ingredients and successfully filed 4; Bloomage Biotechnology Corporation Limited and its affiliated pharmaceutical company filed 3, all classified as biotechnology ingredients.

Frequency of ingredients filing

As of the end of June 2025, Naematelia Aurantialba Fruiting Body Extract had completed 3 filings, making it the ingredient with the highest frequency of filings during this period. Meanwhile, Pyrroloquinoline Quinone Disodium (PQQ) Salt, Fucosyllactose, Dihydroxy Phenylethanol, and Salidroside were each filed twice.

It is worth noting that since 2021, Naematelia Aurantialba Fruiting Body Extract has completed 6 times of new ingredient filings. Classified under Basidiomycota, Tremellomycetes, Tremellaceae, and Tremella genus, it is also known as Golden Tremella – a precious edible and medicinal fungus native to China.Rich in physiologically active substances such as Aurantialba polysaccharides, these mushroom-derived polysaccharides serve as natural moisturizing agents and play a vital role in enhancing the hydrating efficacy of cosmetics. Research indicates that Aurantialba polysaccharides also demonstrate certain antioxidant and repair properties.

Record status change (cancellation/cancellation of record)

In the first half of 2025, three new ingredients were voluntarily canceled from filing, namely the filtrate of yeast/pearl fermentation lysate (National Cosmetics Original Filing No. 20220029), Polyurethane-34 (National Cosmetics Original Filing No. 20220024), and Polyurethane-48 (National Cosmetics Original Filing No. 20220025). By the end of June, a total of 7 new ingredients had been deregistered and 9 had had their filing canceled.

Technology Trend Analysis

In the first half of 2025, new cosmetic ingredients demonstrated a trend of diversified innovation, spanning multiple categories such as plant extracts, bioactive peptides, and synthetic novel compounds. Plant-derived ingredients like Matrine Caffeate and Naematelia Aurantialba Extract precisely align with consumer preferences for natural and gentle components, showcasing unique value in efficacy areas such as soothing and repair; Bioactive peptides like Palmitoyl Pentacosapeptide-12 emerged as new options for anti-aging efficacy ingredients; Synthetic chemical ingredients such as Sodium Hyaluronate Salicylate achieved enhanced efficacy and improved sensory properties through molecular modifications of classic compounds.

Concurrently, diverging industry technical pathways became increasingly distinct: international enterprises prioritized chemical ingredient innovation, leveraging expertise in chemical synthesis to pursue efficacy breakthroughs; Domestic enterprises harnessed advantages in biological extraction technology and plant resources to establish differentiated competitiveness through "Natural + Technology". This divergence stems both from consumer-driven preferences for natural ingredients and reflects the strategic emphasis of domestic/international enterprises on distinct technological capabilities and resources, collectively advancing cosmetic ingredient technology toward greater precision and efficiency through parallel exploration.

For cosmetic enterprises, new ingredients serve as the "key" to product differentiation, yet compliance remains the prerequisite. Enterprises must skillfully utilize new ingredients to craft compelling product narratives while meticulously adhering to regulatory requirements to mitigate filing risks,as only by balancing innovative drive with compliance boundaries can they unlock greater possibilities in cosmetic innovation.

If you have any questions related to cosmetics safety assessment or ingredients use, please contact us via info@enter-co.com.

Also, you can follow us on LinkedIn for the latest cosmetic and toothpaste compliance information.

Comments